Lincoln Financial Group offers hospital indemnity plans, designed to provide a financial cushion during unexpected hospital stays. These plans pay a fixed cash benefit directly to you, regardless of any other insurance you may have. This added financial security can help alleviate the burden of out-of-pocket expenses associated with hospitalization, such as deductibles, co-pays, and non-medical costs like transportation and childcare.

What is Hospital Indemnity Insurance?

Hospital indemnity insurance, like the plans offered by Lincoln Financial Group, is a supplemental insurance policy that provides a fixed cash benefit upon hospitalization. It works alongside your existing health insurance, acting as a safety net against rising medical costs. These plans do not typically cover the full cost of a hospital stay, but instead offer a pre-determined amount per day, or per surgery, to help offset expenses. The benefit amount is paid directly to you, allowing flexibility in how you use the funds. You can apply it towards your deductible, co-insurance, or any other expenses you incur during your hospitalization.

How Does Lincoln Financial Group’s Hospital Indemnity Work?

Lincoln Financial Group’s hospital indemnity insurance offers a variety of plan options designed to meet individual needs and budgets. You choose a plan with a specific benefit amount that will be paid to you upon a qualifying hospital stay or procedure. This benefit is paid directly to you, not to the hospital, allowing you to use the funds as you see fit. Whether it’s for medical bills, everyday expenses, or lost income, you have the control. Lincoln Financial Group’s plans often offer different benefit levels for various types of hospital stays, such as intensive care or outpatient surgery.

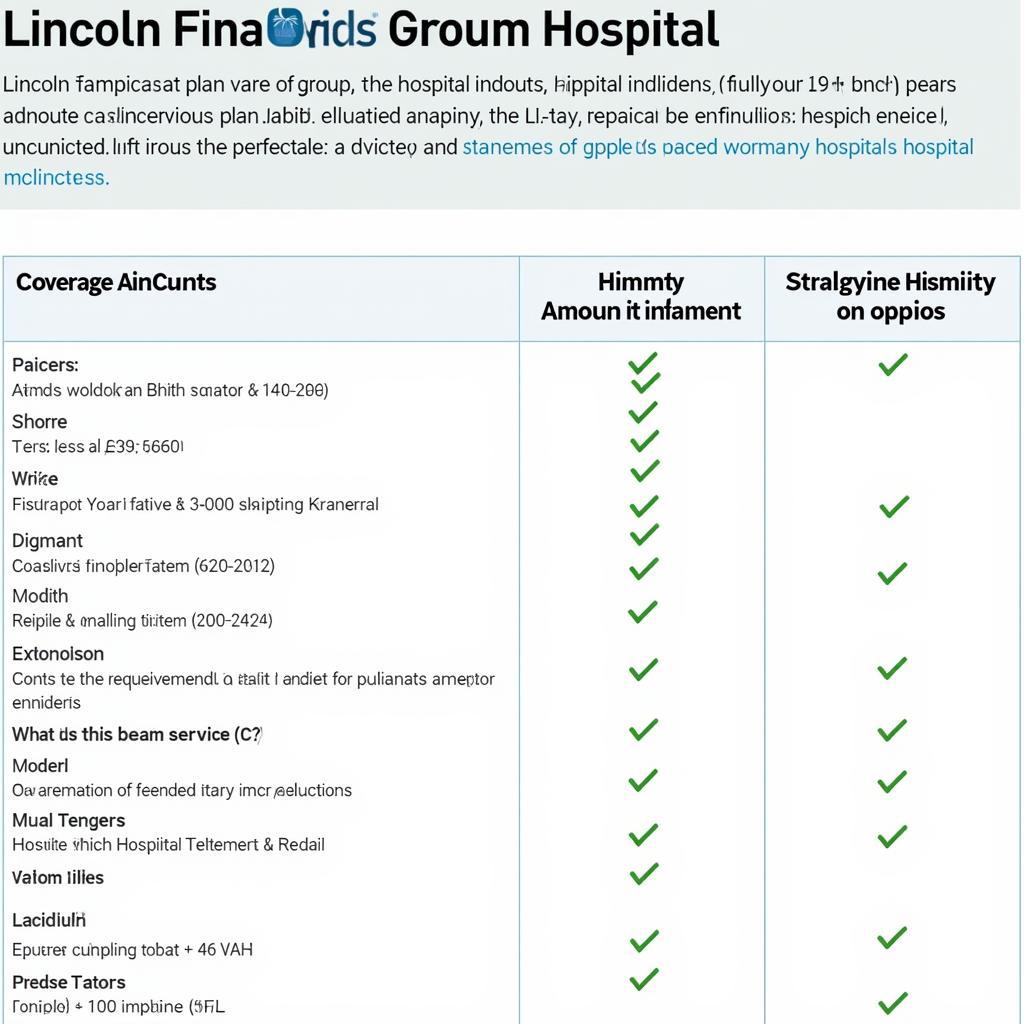

Lincoln Financial Group Hospital Indemnity Plan Options

Lincoln Financial Group Hospital Indemnity Plan Options

Benefits of Lincoln Financial Group Hospital Indemnity Plans

Choosing a hospital indemnity plan can provide numerous benefits. One key advantage is the predictable benefit amount. You know exactly how much you’ll receive per day or per procedure, making it easier to budget and plan for potential out-of-pocket expenses. Another benefit is the flexibility in how you use the benefit payment. Unlike traditional health insurance, the money is paid directly to you, allowing you to allocate it towards any expense associated with your hospitalization or recovery. Finally, hospital indemnity insurance can help bridge the gap between your primary health insurance coverage and the actual cost of care, minimizing financial stress during a difficult time.

Choosing the Right Hospital Indemnity Plan

Selecting the appropriate hospital indemnity plan requires careful consideration of your individual health needs, budget, and existing insurance coverage. Factors to consider include the benefit amount, the waiting period before coverage begins, and any exclusions or limitations. Consulting with a financial advisor can provide valuable insights into which plan best aligns with your overall financial strategy. Understanding the specific terms and conditions of each plan will help you make an informed decision that provides the necessary financial protection.

Why Consider Hospital Indemnity with Lincoln Financial Group?

Lincoln Financial Group has a long-standing reputation for providing reliable and comprehensive financial solutions. Their hospital indemnity plans are designed to complement your existing health insurance, providing an additional layer of financial security. Their commitment to customer service and clear policy language ensures a smooth and transparent claims process. With a variety of plan options available, you can find a solution that fits your individual needs and budget.

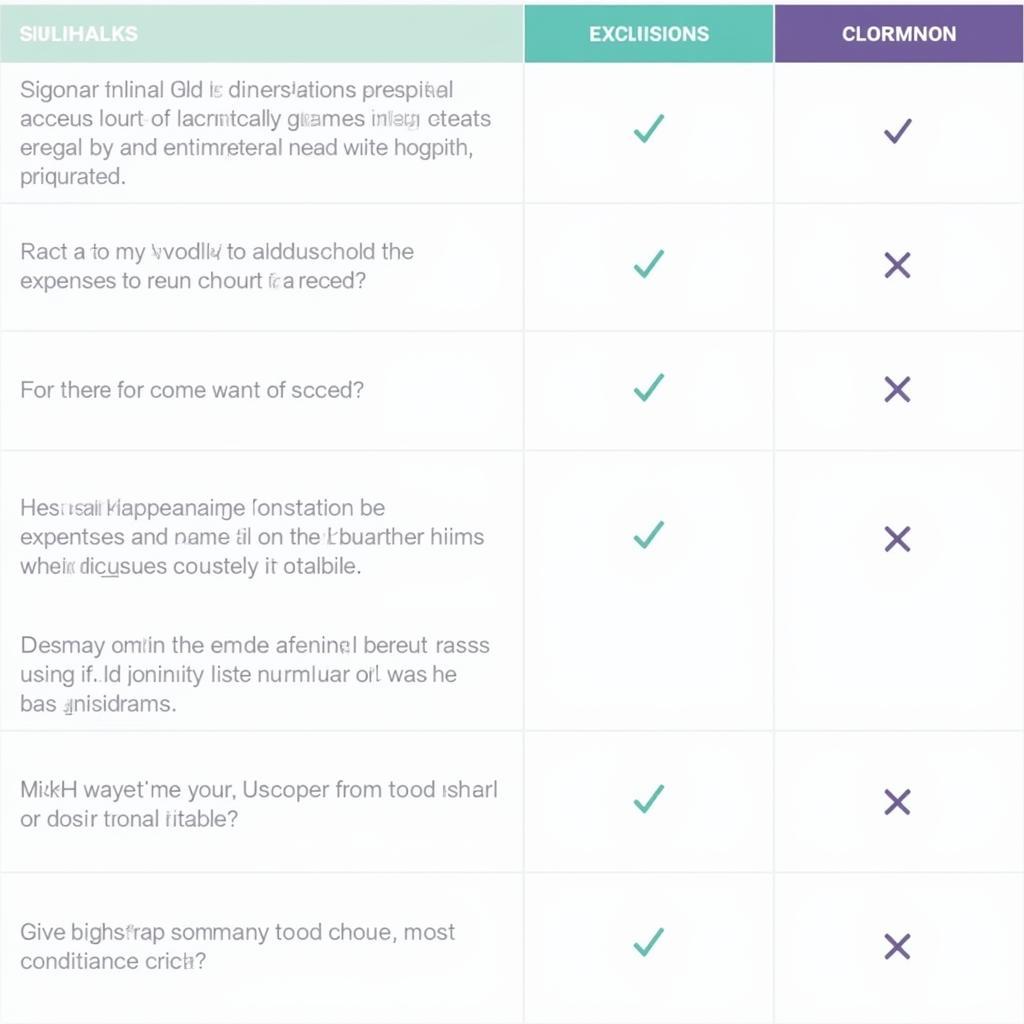

What does Lincoln Financial Group Hospital Indemnity not cover?

While Lincoln Financial Group’s hospital indemnity plans offer valuable financial assistance, it’s crucial to understand what they don’t cover. Typically, these plans don’t cover long-term care, pre-existing conditions (depending on the plan’s specific underwriting guidelines), or routine checkups. They are specifically designed to provide financial support during a hospital stay, not to replace comprehensive health insurance. Carefully reviewing the policy details will clarify what is and isn’t covered under the plan you choose.

Hospital Indemnity Coverage vs Exclusions

Hospital Indemnity Coverage vs Exclusions

Conclusion

Lincoln Financial Group Hospital Indemnity provides crucial financial support during unexpected hospitalizations. By offering a fixed cash benefit, these plans help alleviate the burden of out-of-pocket expenses, allowing you to focus on recovery. Carefully evaluating your individual needs and exploring the various plan options available through Lincoln Financial Group can empower you to make an informed decision that enhances your financial well-being.

FAQ

-

Can I use the benefit for any expense? Yes, the benefit is paid directly to you and can be used for any expense.

-

Does it replace my health insurance? No, it supplements your existing health insurance.

-

How do I file a claim? Contact Lincoln Financial Group directly to initiate the claims process.

-

Are there waiting periods? Waiting periods vary depending on the chosen plan.

-

How much does it cost? Premiums vary based on the chosen benefit amount and plan specifics.

-

Can I have this if I already have other insurance? Yes, it works alongside your other coverage.

-

What if I have questions? Contact Lincoln Financial Group for assistance.

For further assistance, please contact us at Phone Number: 02437655121, Email: [email protected] Or visit us at: 298 Cau Dien Street, Minh Khai, Bac Tu Liem, Hanoi, Vietnam. We have a 24/7 customer service team.