Horry County’s hospitality tax, also known as the tourism development fee (TDF), plays a crucial role in funding infrastructure and services that benefit both residents and visitors. This tax is levied on prepared meals, accommodations, and admissions charges within Horry County, South Carolina, home to popular destinations like Myrtle Beach. Understanding how this tax works and its impact is essential for anyone visiting or residing in the area.

What is the Horry County Hospitality Tax?

The Horry County Hospitality Tax is a 1.5% levy added to the cost of prepared food and beverages, lodging, and admission fees. It’s a key funding mechanism for tourism-related projects and services within the county. This revenue stream supports a wide range of initiatives, from beach renourishment and public safety enhancements to infrastructure development and promotional activities aimed at attracting more visitors.

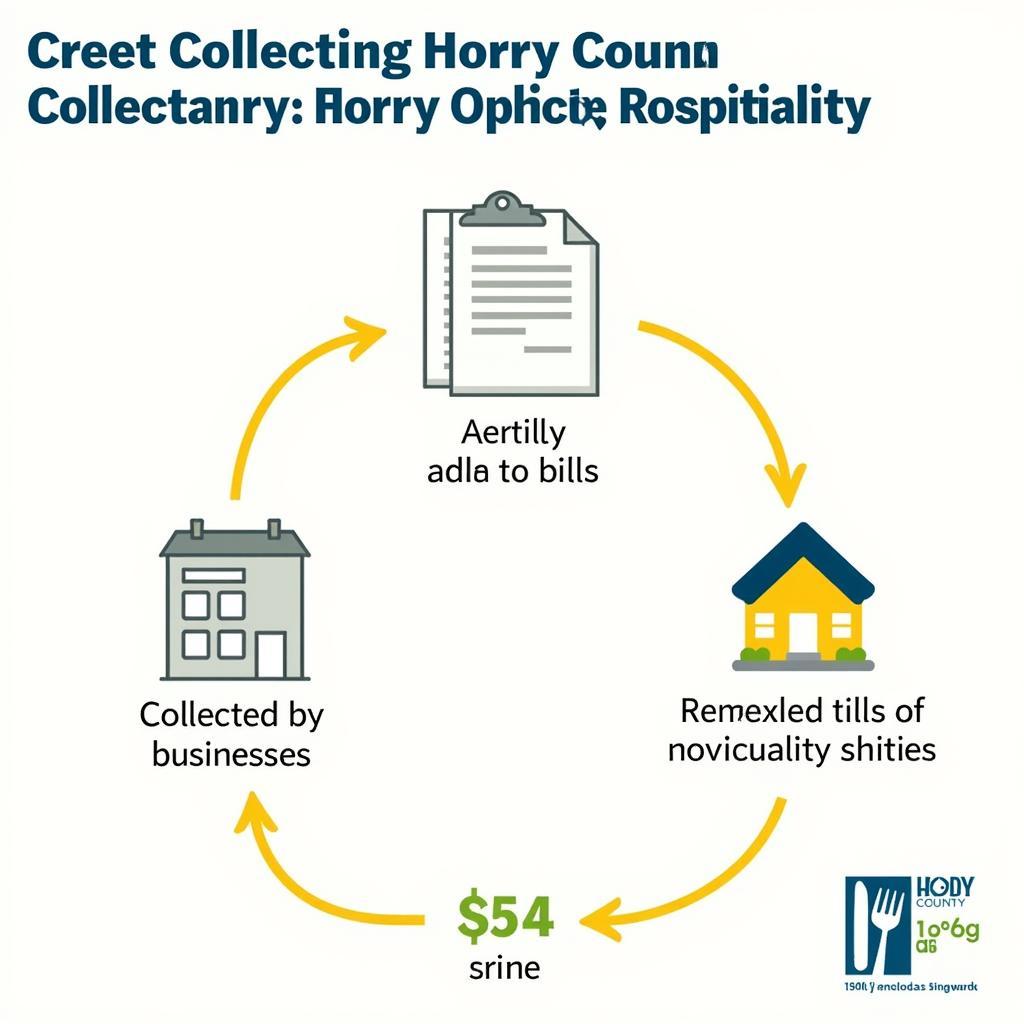

How Does the Horry County Hospitality Tax Work?

When you purchase a prepared meal, rent a hotel room, or buy a ticket to an attraction in Horry County, 1.5% is added to your bill and remitted to the county. These funds are then allocated to specific projects and programs based on the county’s long-term tourism development plans. The tax is designed to be minimally impactful to individual transactions while collectively generating substantial revenue for community improvements.

Horry County Hospitality Tax Collection Process

Horry County Hospitality Tax Collection Process

Who Pays the Horry County Hospitality Tax?

Anyone who purchases prepared meals, accommodations, or admission charges within Horry County pays the hospitality tax. This includes both residents and tourists. While it might seem like a small addition to individual purchases, the cumulative effect of this tax generates millions of dollars annually for the county.

What Does the Horry County Hospitality Tax Fund?

The revenue generated from the Horry County hospitality tax is used to fund a variety of projects and programs, primarily related to tourism development and infrastructure. These projects often include beach renourishment and maintenance, public safety improvements, road construction and maintenance, and marketing initiatives to attract more visitors.

Examples of Horry County Hospitality Tax Funded Projects

The Horry County hospitality tax has financed several significant projects, including beach renourishment projects to protect the coastline, improvements to public parks and recreational facilities, and upgrades to roads and transportation infrastructure. These projects contribute to the overall quality of life for residents and enhance the visitor experience.

Benefits of the Horry County Hospitality Tax for Residents

While tourists contribute significantly to the hospitality tax revenue, residents also benefit from the funded projects. Improved roads, enhanced public safety, and better recreational facilities are just some of the ways residents enjoy the fruits of this tax.

Horry County Hospitality Tax and Tourism Development

The Horry County hospitality tax is instrumental in promoting tourism development within the county. By providing funding for marketing and advertising campaigns, the tax helps attract visitors and boosts the local economy. This, in turn, creates jobs and stimulates business growth.

Impact of the Horry County Hospitality Tax on Local Businesses

The hospitality tax contributes significantly to the success of local businesses by driving tourism and supporting infrastructure improvements. The tax revenue helps create a vibrant and attractive environment that encourages visitors to spend money, ultimately benefiting businesses across various sectors.

Conclusion

The Horry County hospitality tax is a vital funding mechanism for tourism development and infrastructure improvements in the region. By understanding how it works and its impact, both residents and visitors can appreciate its role in enhancing the local community and the visitor experience. The tax ensures that Horry County continues to thrive as a premier tourist destination while providing valuable benefits to its residents.

FAQ

- What is the current rate of the Horry County hospitality tax? (1.5%)

- What types of purchases are subject to the hospitality tax? (Prepared meals, accommodations, and admission fees)

- How is the collected tax revenue used? (Funding tourism-related projects and services)

- Do residents of Horry County pay the hospitality tax? (Yes, on applicable purchases)

- How does the hospitality tax benefit local businesses? (Drives tourism, supports infrastructure improvements)

- Where can I find more information about specific projects funded by the hospitality tax? (Horry County website)

- Who oversees the allocation of the hospitality tax revenue? (Horry County Council)

Common Scenarios

- Dining out: When you pay your bill at a restaurant, the hospitality tax will be included as a separate line item.

- Staying at a hotel: The hospitality tax will be added to your total room charge at checkout.

- Visiting an attraction: The tax will be included in the ticket price for attractions subject to the tax.

Related Resources

- Horry County Government Website

- South Carolina Department of Revenue

Need support? Contact us at Phone Number: 02437655121, Email: [email protected] Or visit us at: No. 298 Cau Dien Street, Minh Khai, Bac Tu Liem, Hanoi, Vietnam. We have a 24/7 customer service team.