Navigating the world of health insurance can feel like charting unknown territory. One minute you’re deciphering copays, the next you’re grappling with deductibles. And then there’s hospital indemnity insurance, a policy designed to provide financial support when you’re hospitalized. Among the many providers, MetLife stands out with its range of options. But when it comes to MetLife Hospital Indemnity, what exactly is the difference between low and high coverage?

This article dives deep into the nuances of MetLife Hospital Indemnity, helping you understand the difference between low and high coverage, and ultimately empowering you to make informed decisions about your health insurance needs.

Decoding Hospital Indemnity Insurance: What’s the Big Deal?

Before we delve into the specifics of MetLife’s offerings, let’s clarify what hospital indemnity insurance actually is. Unlike traditional health insurance that directly covers medical bills, hospital indemnity insurance provides a fixed cash benefit when you’re hospitalized. This means you receive a predetermined sum per day, regardless of the actual cost of your medical expenses.

Think of it as a financial safety net. You can use this cash payout to cover a wide range of expenses, from deductibles and copays to everyday living expenses that continue even when you’re hospitalized, like rent, groceries, or childcare.

MetLife Hospital Indemnity: Low vs. High Coverage – What’s the Difference?

The key difference between low and high coverage in MetLife Hospital Indemnity boils down to the daily benefit amount you choose.

-

Low Coverage: Opting for a lower coverage plan means you’ll receive a smaller fixed amount per day of hospitalization. This translates to lower monthly premiums, making it a budget-friendly option for those seeking basic financial protection.

-

High Coverage: Conversely, a higher coverage plan comes with a larger daily benefit amount. While this means higher monthly premiums, it provides greater financial peace of mind and a larger safety net to cushion the financial impact of unexpected hospital stays.

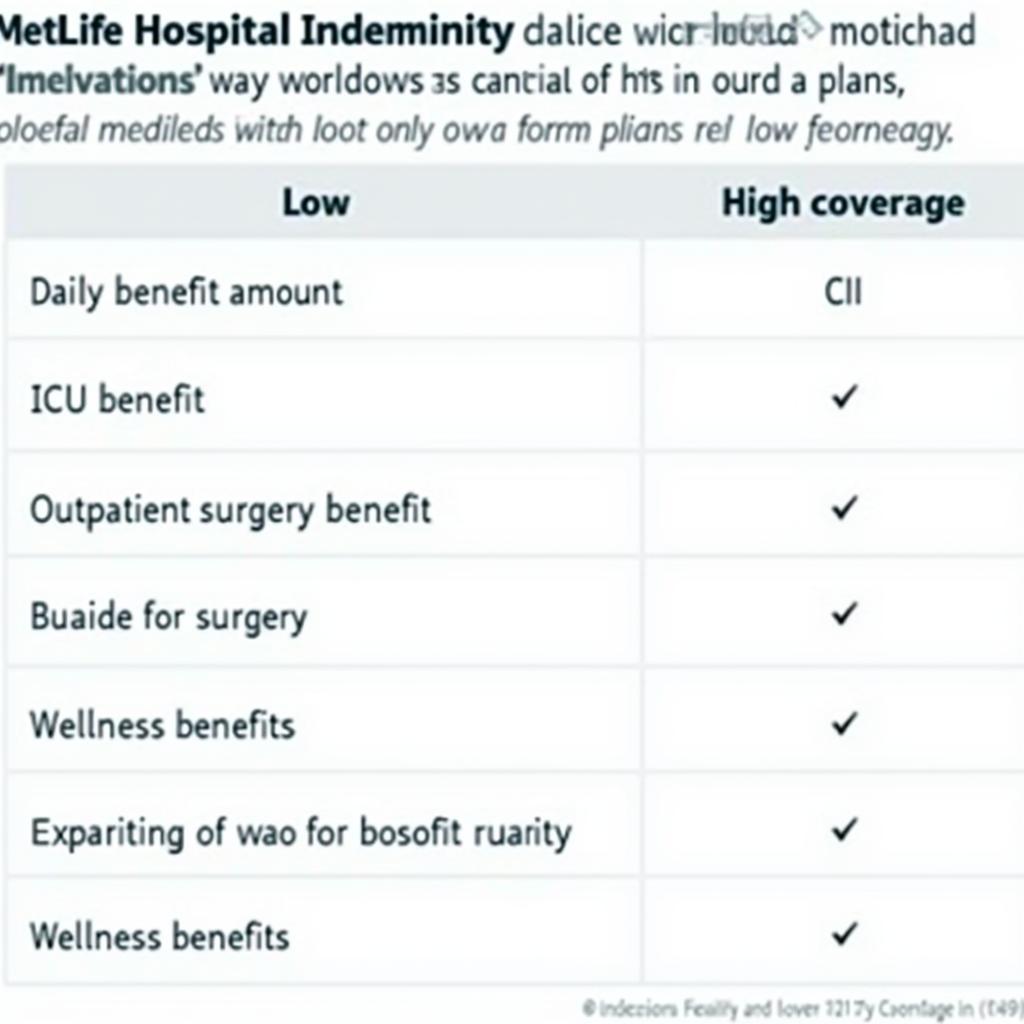

MetLife Hospital Indemnity Coverage Options

MetLife Hospital Indemnity Coverage Options

Factors to Consider When Choosing Your Coverage Level

Selecting the right coverage level for your needs isn’t a one-size-fits-all scenario. It requires careful consideration of your individual circumstances and financial situation. Here are some key factors to weigh:

-

Your Budget: Evaluate your monthly budget and determine how much you can comfortably afford for premiums. Remember, a lower premium shouldn’t come at the expense of leaving you financially vulnerable in case of hospitalization.

-

Your Health History: Consider your personal health history and any pre-existing conditions. If you have a higher risk of hospitalization, opting for a higher coverage level might be a prudent choice.

-

Your Existing Health Insurance: Assess your current health insurance plan. Hospital indemnity insurance should complement, not replace, your primary health insurance. If you have a high-deductible health plan, a higher coverage level might be beneficial in offsetting those costs.

Beyond the Basics: Additional Benefits of MetLife Hospital Indemnity

MetLife Hospital Indemnity plans often come with additional benefits that enhance your coverage and provide added value. These may include:

-

Intensive Care Unit (ICU) Benefit: This benefit provides a higher payout for each day you spend in the ICU, reflecting the increased costs associated with critical care.

-

Outpatient Surgery Benefit: Some plans offer coverage for outpatient surgeries, providing a fixed benefit for procedures that don’t require an overnight hospital stay.

-

Wellness Benefits: MetLife may offer access to wellness programs, discounts on health-related services, or resources to help you maintain a healthy lifestyle.

MetLife Hospital Indemnity Benefits Comparison

MetLife Hospital Indemnity Benefits Comparison

Making the Right Choice: Seek Expert Guidance

Choosing the optimal MetLife Hospital Indemnity plan requires careful evaluation of your individual needs and circumstances. It’s essential to thoroughly review the policy documents, understand the terms and conditions, and seek clarification on any aspects that are unclear.

“Don’t hesitate to reach out to a qualified insurance professional,” advises John Smith, a certified financial advisor specializing in health insurance. “They can provide personalized guidance, assess your specific requirements, and help you select a plan that aligns with your budget and coverage needs.”

Conclusion: Navigating Your Healthcare Journey with Confidence

In the complex landscape of health insurance, MetLife Hospital Indemnity offers a valuable safety net, providing financial support during unexpected hospitalizations. By understanding the distinction between low and high coverage options, considering your individual circumstances, and seeking expert advice, you can confidently navigate your healthcare journey and make informed decisions that prioritize both your health and financial well-being.

Ready to explore your options? Contact San Jose Hospital today at 02437655121 or [email protected]. Our dedicated team is available 24/7 to answer your questions, provide personalized guidance, and help you find the ideal healthcare solution for your needs. We’re located at Số 298 Đ. Cầu Diễn, Minh Khai, Bắc Từ Liêm, Hà Nội, Việt Nam. Your health and well-being are our top priorities.